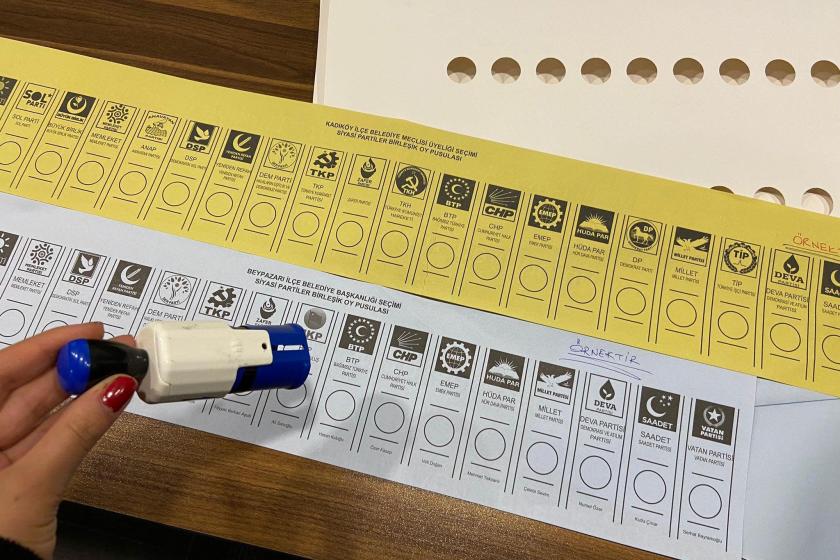

Photograph: Evrensel

Onur BAKIR

Trade union expert

Treasury and Finance Minister Berat Albayrak proclaimed the New Economic Programme in October 2018 and signalled coming attacks on severance pay and social security. To avoid courting controversy prior to the local elections, the ruling party postponed its plans until after the elections. On the eve of the election, the Turkish Industry and Business Association appealed to the ruling party, calling for “structural reform.” For his part, President Erdoğan, stressing there would be no elections for four and a half years, said he would focus on the economy and reforms and gave the bosses the green light. The arguments over the elections may not yet have died down, but the ruling party has moved into action to fulfil the promises it gave capital. Minister Albayrak held a press conference and explained when and how the policies contained in the New Economic Programme would be delivered.

In his announcement, Albayrak stated that by the end of 2019:

The individual retirement system would be restructured,

A severance pay fund would be created and this fund would be integrated into the individual retirement fund, and

Amounts accumulating in funds would be made available to companies as cheap finance.

There is as yet no detailed information or bill. However, based on Albayrak’s comments and reports carried by the press, we can say that a model of the following kind is envisaged:

Those who have exited the compulsory individual retirement system (IRS) will be reincluded within the system and the right to cancel within two months will be dispensed with. Workers and public staff will not be entitled to exit the system for a certain minimum period (e.g. five years). A three per cent IRS contribution will be docked from workers every month. The contributions so docked will accumulate in a worker’s IRS account but it will not be possible to withdraw this amount for a certain period. It will be possible to exit the system once this minimum period has ended. However, if a worker wishes to exit the system without having paid at least ten years’ contributions and before reaching the age of 56, they will incur very serious losses. The partial or full recouping of the state contributions found in the present implementation, a retroactive entrance fee and the collection of a management fee deduction for each year spent in the system and also the imposition of withholding tax on the ensuing income will be involved. That is, the worker will be between a rock and a hard place.

A severance pay fund will be established. Just as with the compulsory IRS, workers will have separate individual accounts in the severance pay fund. The individual retirement account and the severance pay account will be integrated. That is, these two accounts will either be consolidated into a single account or will be interrelated. Employers will deposit severance pay contributions into workers’ severance accounts each month. With the worker paying the contribution under the IRS, the employer will make the severance pay fund contribution from their own funds. However, as with the IRS, the worker will be unable to withdraw their money whenever they wish in the severance pay fund system. The worker will have to wait for a minimum period and will be unable to touch the severance fund even if they are dismissed or leave work within this period. A worker wishing to obtain their money in the fund after this minimum period but before their retirement date will once more incur serious deductions and losses.

It will be compulsory to enter both systems but exiting will not be easy. As such, considerable amounts will accumulate in the IRS and severance pay fund. However, workers will be unable to touch their own savings. As Albayrak clearly said at the press conference, the funds accumulating in the system will be channelled into the real sector and companies will be provided with a cheap source of finance. Funds forcibly usurped from workers and employees will be handed on a golden tray to companies as cheap loans. Bosses, who exploit workers in workplaces, factories and workshops, will also get cheap loans from the sweat of workers’ brows and will enjoy double exploitation.

These are the conclusions to emerge from Albayrak’s comments. There is as yet no bill and the details are uncertain. However, the ruling party’s intention is clear and manifest. The ruling party is aiming to enact these policies by the end of 2019. Mayday, as it draws near, assumes even greater importance against this backdrop.

Twist and turn it as much as you like, the IRS does not profit workers but causes them loss. Using a bank’s calculator, when we look back over a period of one and five years from November 2018, the result we get is that over the past year the IRS has produced an average return of 12.3%, while inflation was at 23.6% in the same period. This means that, while the worker’s 100 TL in the system should be at least 123.6 TL, the worker’s money is a mere 112.3 lira. As to the past five years, with the IRS yielding an average return of 49.2 TL, inflation was 73.3% in the same period. So, as time goes by, the difference between inflation and the IRS’s return (growth, yield) increases. This results in the worker’s money being eaten away by inflation. The 25% state contribution does not counteract this loss of value, either, because no state contribution is made to workers who exit the system within less than three years, 85% of the contribution made to workers who exit within three to six years is recouped and 65% of the contribution made to workers who exit within six to ten years is recouped, while, following ten years, 50% is recouped from workers who exit at the age of less than 56. On the other hand, early exiting from the system incurs a whole host of deductions. As such, never mind keeping up with inflation, the worker is only able to secure payment of a smaller amount than the contributions coming out of the worker’s pocket.

In saying, “Our citizens will have no concerns as to how they will get by after retiring,” Minister Albayrak has acknowledged that pensions are inadequate. The solution Albayrak has come up with, though, is “top-up” insurance, that is the individual insurance system. However, it is the very ruling party that is to blame for this situation! Following a law that took effect in 2008, the replacement rate was reduced to 40% in the period following 2008. Today a married worker on the minimum wage with one child whose wife does not work gets 2,088 TL per month. The pension allotted to a worker whose entire service period follows 2008 will be roughly 903 TL, that is, the worker will be able to get a pension of less than half the amount they earn. The solution the ruling party has come up with is to dock further IRS compulsory contributions from workers from whose gross pay Social Insurance Institution contributions are deducted. However, the IRS does not compensate for this loss. For example, somebody on the minimum wage who is now 35 will be able to get 123 TL in IRS income even if they make IRS contributions until they are 56. In this case, the total of the pension and IRS pension will only amount to just half the worker’s monthly income.

1) Severance pay will cease to give security of employment

Six out of every ten workers in Turkey lack security of employment. The vast majority of these workers are employed at small workplaces employing fewer than thirty workers. Bosses can dismiss these workers any time they like, even without citing a reason. But these workers cannot sue for reinstatement of employment. So, the only security workers in this situation have is severance pay because bosses need to think twice before dismissing these workers because of the severance pay liability. However, bosses will no longer be bothered by such things in the fund system. Especially workers employed at small workplaces will be deprived of their sole protection.

2) Sacking will be easier

The transfer of severance pay to the fund will not just be a loss for workers employed at small workplaces. Severance pay will cease to provide job security for workers employed at large workplaces who have the security of employment and even trade unions and collective agreements, too. In fact, the bosses’ chief concern is to reduce severance pay liabilities thus enabling them to sack workers more easily. In conjunction with the fund system, the cost to bosses will both fall and sacking will be easier as severance pay will not be an entitlement payable on dismissal. It will be far simpler to get rid of workers who have been employed for years in the same workplace and have long service periods.

3) Severance pay will not be a friend in hard times

Severance pay is the friend in hard times of those who have been dismissed or leave work in a way that gives entitlement to severance pay. In Turkey, where unemployment benefit is limited in terms both of amount and duration, severance pay is a lifebuoy for workers who lose their jobs. The worker pays off their debts and bills, keeps their cauldron boiling and pays their children’s school expenses out of severance pay. However, under the fund system, a worker who is dismissed or quits will be unable to get their money in the fund even if they ask for it if they have not yet completed the minimum period. Even if they have completed the minimum period, they may incur large losses if they apply to get their money prior to retirement.

4) An end to dowries or military service cash

A male worker who goes off to do his military service gets his severance pay. A female worker can get her severance pay and quit within one year of marriage. Severance pay is a dowry and military service cash. But, under the fund system, they may be unable to withdraw their money in the fund even if they leave work due to military service or marriage.

5) The worker will be deprived of their severance pay trump card

Contrary to what is imagined, a worker who leaves the job can also get severance pay. If the worker, rather than resigning, exercises their justifiable termination right – provided the conditions are met - they can get severance pay. For example, a worker who is paid short or late is not given over time, is not provided with health safety precautions or suffers mobbing can invoke justifiable termination and leave the job while also getting severance pay. However, under the fund system, an employee who has suffered unfair treatment will no longer be able to play the trump card of “I’ll get my severance pay and go.” Bosses, knowing that they will not make a payment from their own pocket, will be able to act even more audaciously and brazenly and usurp workers’ rights even more easily. On the other hand, even if the worker makes justifiable termination, they may be unable to get their money in the fund if they have not completed the minimum period.

6) The entitlement will not be calculated based on final remuneration

Severance pay is calculated based on the final total remuneration. That is, regardless of how many years the worker has worked and how much they earned in the past years, they get their severance pay based on their last wage. For example, the severance pay of a worker who set out as a cashier and worked for ten years on the minimum wage and was then promoted to cash desk supervisor and moved onto one and half times the minimum wage will then be calculated at one and a half times the minimum wage. However, in the fund system, the employer will deposit the severance contribution based on the worker’s wage that month. Hence, the severance contribution of the worker in this example would have been deposited at the minimum wage for ten years and the worker would get considerably less severance pay. Not basing the calculation of the entitlement on final remuneration may reduce severance pay by a third or even a half.

7) Severance pay of those with contributions based on understatement will also fall

In Turkey, workers who can be counted in their millions get paid more than the amount reported to the Social Insurance Institution because bosses understate workers’ pay to make lower contributions or even make contributions at the minimum wage. In the fund system, as severance deposits will be made on the basis, not of the worker’s true wage but that reported to the Social Insurance Institution, a loss will also ensue from this.

8) Fringe benefits such as transport and meals will not be reflected in severance pay

Workers may not be given meal and travel allowances, but be provided with meals at the workplace and transport. The equivalent of these meal and transport entitlements are included in severance pay calculations. But, in the fund system, non-monetary entitlements will not be reflected in severance pay. On the other hand, if the severance pay contribution is calculated on remuneration subject to insurance contribution deductions, entitlements from which insurance contributions are not docked (e.g. cash handling supplement, child and family enhancement) will be excluded from the calculation.

9) Inflation may eat into workers’ severance pay

As in the compulsory IRS system, the money deposited in the worker’s account in the severance pay fund system will be put to work and will multiply. However, there is no guarantee that the worker’s money will retain its value against inflation. In the past year alone, workers’ contributions in the compulsory IRS system have lost 10% of their value to inflation. If a similar situation is experienced in the severance pay fund system, it is highly likely that workers’ severance pay will diminish in value.

10) Severance pay may come down from thirty days

Severance pay is calculated at thirty days’ pay for each year of service. Bosses are violently opposed to this rule and are demanding a reduction to the thirty days (e.g. to at least fourteen days). We do not yet know what kind of rule will be introduced in the fund system, but it is highly likely to be brought down from thirty days. In this case, severance pay will take another blow and well and truly shrink.

(Translated by Tim Drayton)